Plant-based’ plays way better than ‘vegan’ with most consumers, says Mattson

On the face of it, the terms ‘vegan’ and ‘plant-based’ might appear to be interchangeable (they both involve avoiding animal products), but consumers do not view them in the same way, reveals new research from food development specialist Mattson.

In a national online survey of 1,163 US adults conducted by Mattson last summer, respondents were asked to select either ‘100% plantbased’ or ‘vegan’ to a series of questions, said president and chief innovation officer Barb Stuckey.

Where does the future (lie)?

100% plant-based: 83%

Vegan: 17%

Which is more flexible?

100% plant-based: 79%

Vegan: 21%

Which offers more for me?

100% plant-based: 76%

Vegan: 24%

Which tastes better?

100% plant-based: 73%

Vegan: 27%

Which is healthier ?

100% plant-based: 68%

Vegan: 32%

In every case, ‘plant-based’ was selected by the vast majority, because consumers tend to see plant-based as a positive dietary choice, whereas following a vegan diet is seen as a lifestyle associated with serious commitment, deprivation, and allegiance to a ‘cause’ that defines them (animal rights, environmental activism), said Stuckey.

“Simply by changing the conversation you can make food taste better,” added Stuckey, who was speaking at Mattson’s Plant Based Food Innovation Summit at its new HQ in Foster City, CA on Tuesday.

“’Vegan’ is about deprivation, it’s about saying no, no, no, » added Stuckey, who noted that consumers were only given two options (vegan or plant-based, and not a third option along the lines of ‘both are the same’) but said the exercise provided a useful insight into how consumers are thinking.

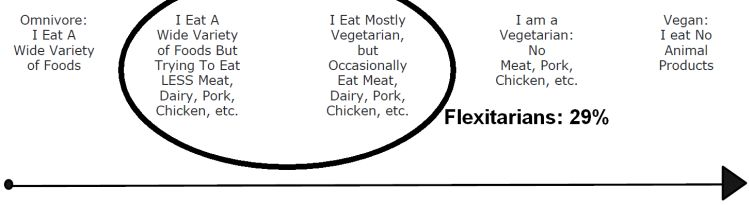

Almost a third of Americans are flexitarians (even if they don’t recognize the term)

Of the respondents – 48% of which said they plan to eat more plant-based foods in future – 2% were classified by Mattson as vegans (no animal products), 4% as vegetarians (no meat), 64% as omnivores (I eat what I want), and 29% as flexitarians – split into those cutting down on meat (20%) and those following a mostly vegetarian diet, but eating meat occasionally (9%).

“29% as exitarians. That’s almost a third of consumers ,” said Stuckey. “And that’s a big market opportunity.”

Why are consumers interested in plant-based?

Asked why they might choose plant-based foods more often, ‘health benefits ‘was the #1 factor, cited by 76% of respondents, followed by ‘to lose weight’ and ‘to feel better’ (both at 44%) ahead of the ‘better for environment’ (31%) and ‘animal welfare’ (23%), noted Stuckey.

“What’s interesting is that when you ask people in focus groups why plant-based foods are better for you, they don’t know , unless you are talking to very engaged consumers.”

The results were echoed by a national Datassential survey presented at the same event in which ‘overall personal health,’ ‘manage and avoid diseases’ and ‘weight loss’ were cited as the top three reasons for eating less meat.

Why are consumers interested in clean meat, animal-free eggs, dairy?

By contrast, the top three reasons consumers in the Datassential survey were interested in cellular agriculture (growing meat and fish from culturing cells instead of raising and killing animals, or producing dairy and egg proteins via microbial fermentation for example) were ‘reducing global hunger,’ ‘less food contamination,’ and ‘animal welfare,’ highlighting how firms marketing and positioning such products may need to deploy slightly different tactics to compatriots in the plant-based arena.

Where should plant-based meat, dairy, be merchandised?

In a follow up survey, Mattson asked 390 consumers which plant-based burgers and grounds they preferred based on a picture and description (with no branding) of a frozen vs a refrigerated product, and in both cases, shoppers preferred the ‘fresh’ option, echoing the findings of other surveys suggesting consumers perceive chilled food to be fresher and more premium than frozen, said Stuckey.

That said, not every plant-based brand necessarily wants to sit in the meat counter next to meat (a move that significantly boosted sales for the Beyond Burger), noted delegates and speakers at the event, especially if they are deliberately targeting strict vegans or vegetarians rather than flexitarians.

“We are an animal activist company and being right next to meat doesn’t feel right for us, but then we don’t want to be shoved away in a place in the store where no one can find us either ,” said Dr Marcia Walker at plantbased meat brand Tofurky.

In the dairy set, merchandising is a mixed bag, with plant-based milks and yogurts typically sitting alongside their dairy-based counterparts, but plant-based cheeses more typically stocked at a separate location, noted delegates.

“People weigh up their options at the shelf, and if we’re not adjacent to what we’re trying to substitute for, we’re lost ,” said Dr Neil Renninger, co-founder at pea-protein-fueled plant-based brand Ripple Foods.

Taste, functionality in plant-based proteins

While the quality of meat and dairy analogs has improved considerably in recent years, and the arrival of new brands utilizing proprietary technology such as Beyond Meat, Impossible Foods and Ripple Foods has increased the profile of the sector, challenges remain when it comes to taste and functionality, said Dr Renninger.

“Traditionally, you have ingredient suppliers and product developers [in the plant-based food space], and not a lot of real R&D in either place, so from a taste perspective, the ingredients have been lacking, which is why we created our own [Ripple utilizes proprietary technology that strips out unwanted components from commercially available plant protein isolates to yield a neutral-tasting protein, ‘Riptein,’ that can be incorporated into foods and beverages in high quantities]. »

“So you’re seeing companies like ours that innovate on the ingredients side and create IP that allows us to develop proprietary products and bring them to market and capture some of the value from those ingredients. It’s a different business model; and I don’t know how long it will last.”

Cellular agriculture: We were surprised by how open consumers were to it

Cellular agriculture companies such as Clara Foods, Memphis Meats and Perfect Day, in turn, are adopting a different approach.

Rather than trying to mimic the taste, texture and functionality of animal protein with plants, why not produce the dairy, egg and meat proteins consumers enjoy and formulators are familiar with, without raising or slaughtering animals, asked Arturo Elizondo, CEO at Clara Foods, which is developing fermentation technology to produce egg white proteins from yeast.

There is also an environmental element at play here, said Elizondo.

Why devote vast tracts of land and dedicate resources to growing plants if you are only able to utilize certain components in them, he asked. “It’s not very efficient and it creates waste and so instead of this top down approach where you’re extracting what you want, why not just create it directly?” When it comes to consumer acceptance for foods produced via cellular agriculture, much depends how you phrase survey questions, acknowledged Colleen McClellan, director, client solutions, at foodservice market researcher Datassential.

However, consumers surveyed by Datassential about cultured meat and other products have proved “surprisingly ” receptive, she said. “We were shocked by how open people are to it. We thought that the ick-factor would be bigger.”

The GMO factor

That said, any company in this space utilizing genetic engineering has to find a way to communicate that with consumers without scaring people off, said Dr Renninger at Ripple Foods.

“It’s troubling to me that [the debate has become so polarized/charged] you can’t even have a conversation about it anymore.”

Source : Foodnavigator